Worker demands for perks on the job are being met head-on by employers these days. Organizations that are eager to keep talented staff and lure potential new candidates to their offices are developing procedures and creating benefit packages that appeal to the masses, according to Frank Karlinski, a senior vice president at Robert Half on an NJCPA webinar earlier this month.

Currently, he said, there are 11 million open jobs nationally, which is 2 million higher than during 2021. This, according to Karlinski, is “a huge jump.” In addition, the quit level, which is the number of people who are voluntarily leaving their job on a monthly basis, is at about 2.7 percent (4.1 million), which is high but down from the record highs over the summer at 3 percent, he added.

With a national backdrop of a strong hiring market, low unemployment rate of 3.4 percent nationally and unemployment related to accounting and finance of a little over 2 percent, it’s no wonder that retaining people is a top priority, he said. Some of the lowest levels of unemployment are in financial planning and analysis (FP&A), corporate accounting, public tax accounting and audit, and some specific roles within accounting and finance, which are almost at zero unemployment.

According to Robert Half research, national employers are attracting skilled workers by the following breakdown:

- Higher starting salaries (46 percent)

- Signing bonuses (34 percent)

- Flexible work options (33 percent)

- Hiring of remote candidates (31 percent)

Compensation Trends

A common hiring trend currently is employers having to offer higher salaries, he said. “Companies need to be proactive in addressing employee needs regarding compensation. If you are not doing this, you will lose people,” he said. “Signing bonuses is something where we’ve seen a pretty big uptick.”

However, accounting and finance organizations, in particular, are faced with internal equity challenges such as people being hired at higher salaries than what the existing people at a similar level are making. “It’s absolutely a problem and absolutely something that companies need to be proactive in addressing,” he admits. “Sixty percent said existing employees have raised concerns about this. Eighty-two percent have given raises to those who raised concerns. If you are not doing this, from my experience in my day-to-day job, you will lose people.”

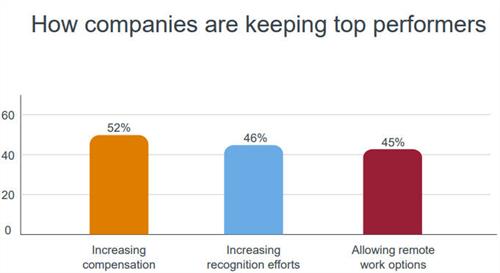

So, how does an organization keep people? “It is challenging to retain people because the best people are sought after.” But, compensation helps, he admits, as does incorporating remote and hybrid work options. See table 1.

Table 1

Hybrid/Remote/Flexible Opportunities

Allowing workers to use hybrid/remote work is a necessity in today’s market. “This is a differentiating factor that employers can offer, and should offer, but there’s a benefit to the employers too.” This applies specifically to remote options, but hybrid options as well, he said. “Flexible work is really no longer seen as a benefit that a company offers it; it’s more or less an expectation at this point.”

And when that kind of work option is presented as too much of a bonus or benefit and not the norm, often employees come to consider it as one of the sole reasons they are working there at all. “Sixty percent of employees are working fully remote or on a hybrid basis at this point. I would argue in New Jersey that number is higher in accounting and finance,” he said, noting that within public accounting he has seen a huge increase in firms letting employees work in this manner. “It’s been a very useful tool in attraction and retention to employees, specifically in public accounting.”

Flexible work schedules and altering times of the workday, such as time blocking and work blocking, are also popular. These have become so much in demand that, according to Robert Half data, more than 40 percent of the current workforce on a national scale is planning to find a new job looking for these attributes, he said. Similarly, more than 50 percent prefer a fully remote position, while 55 percent are open to hybrid schedules. These perks lead to an increase in morale by almost 60 percent, and greater productivity by more than 30 percent, he said.

“There is a big difference being open to a hybrid environment versus a fully remote environment, especially when you are looking at specialized skillsets,” he said, noting that a hybrid employee limits the candidate pool to those who can commute. A fully remote employee gives employers the option to look nationally to fill that role.

“Generally speaking, public accounting has lagged behind private industry in their willingness to have people work completely remote. I am seeing a lot more of it this season, but, as a trend, they are definitely lagging behind industry at this point,” he explained.