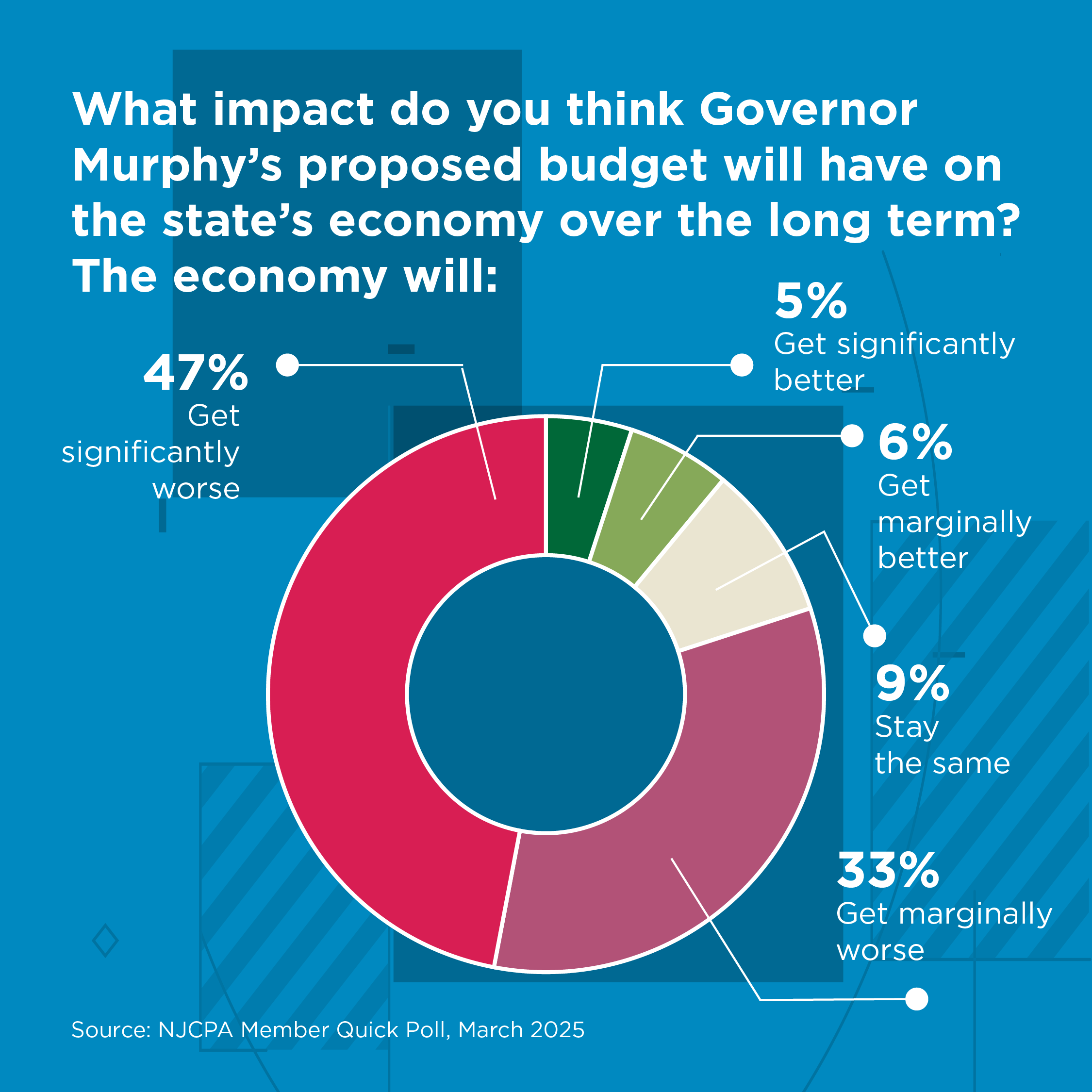

80% of CPAs Surveyed Are Concerned Governor Murphy’s Proposed $58.1B Budget Will Leave Economy Worse

–

March 10, 2025

Respondents Ask for More Tax Relief and Less Non-Essential Spending

Eighty percent of the 350 certified public accountants (CPAs) surveyed by the New Jersey Society of Certified Public Accountants (NJCPA) after Governor Murphy proposed his $58.1 billion budget for fiscal year 2026 on Feb. 25 said the budget will leave the state’s economy either marginally worse or significantly worse over the long term. Forty-seven percent said the economy would get “significantly worse” and 33% said it would get “marginally worse.”

With the looming threat of federal cuts to Medicaid and NJ Transit funding, 80% of the respondents also said Governor Murphy should have made additional cuts to prepare for the worst-case scenario. Survey respondents flagged several areas for cost-cutting measures that the Murphy Administration should have focused on, which include government spending on non-core services, the state’s pension obligations, not paying out unused vacation pay to legislators upon retirement, eliminating duplication in municipal services, reducing taxes on personal income and real estate, making state spending more efficient and privatizing NJ Transit. They also recommended lowering corporate taxes to attract more companies to move to the state.

In his final budget address in office, Governor Murphy highlighted having a proposed budget surplus of $6.3 billion. The proposal also includes a $7.2 billion payment to the pension system; $4.3 billion in property tax relief to New Jerseyans under its Direct Property Tax Relief program and $2.4 billion for the continuation of the Affordable New Jersey Communities for Homeowners and Renters (ANCHOR) program; tax increases for the highest tier of realty transfer fees, sports betting, alcohol, adult-use marijuana and cigarettes, along with a new exemption for small business investment; $12.1 billion for K-12 schools; $1.23 billion for critical investments in state and local highway and bridge projects and $767 million for NJ Transit capital projects.

The Governor discussed many initiatives for building New Jersey’s future, including the creation of its Economic Council, which provides a regular forum for the business community and state government to work together; providing $20 million in additional funding to attract innovative businesses and talented workers to New Jersey through Strategic Innovation Centers, the state’s program to cement leadership in the industries of tomorrow; and the success of its Cannabis Regulatory Commission, which has overseen billions of dollars of legal cannabis sales, including more than $1 billion in 2024.

“We welcome CPAs to be included in conversations regarding the state’s economic well-being and how to improve the business landscape. Their work resonates across all industries, which makes them a valuable resource for lawmakers,” said Aiysha (AJ) Johnson, MA, IOM, CEO and executive director at the NJCPA.