Half of CPAs Surveyed Said Their Clients’ Net Tax Bill Increased as a Result of the Cap on SALT Deductions

–

February 6, 2025

65% of Those with Incomes Between

$150,000 to $324,999 Saw a Rise

Half (50%) of the 325 CPAs surveyed by the New Jersey Society of Certified Public Accountants (NJCPA) in January said their clients’ net tax bill had gone up because of the $10,000 cap on state and local tax (SALT) deductions. This compares with 30% who said their clients’ net tax bill had not gone up and 20% who were not sure. Six-five percent of clients whose net income is between $150,000 and $324,999 had their net tax bill rise, and 64% of clients in the $325,000 to $999,999 income tax bracket saw an increase.

The survey was created to gauge the impact of the $10,000 cap on SALT deductions imposed by the Tax Cuts and Jobs Act (TCJA) in 2017. The cap is due to expire this year.

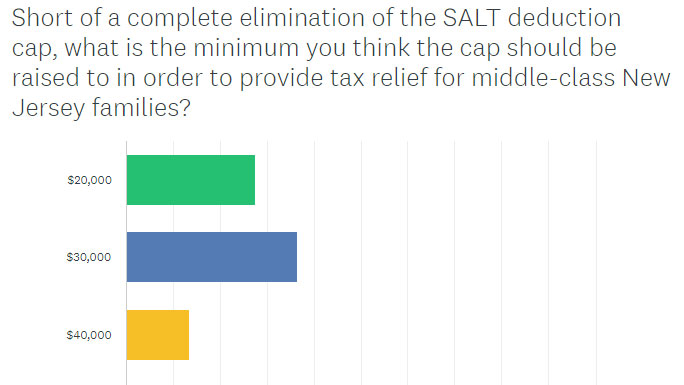

When asked the minimum amount the cap should be raised to in order to provide tax relief for middle-class New Jersey families, barring a complete elimination, 37% of survey participants cited $30,000 and 28% said $20,000. Only 22% said $50,000.

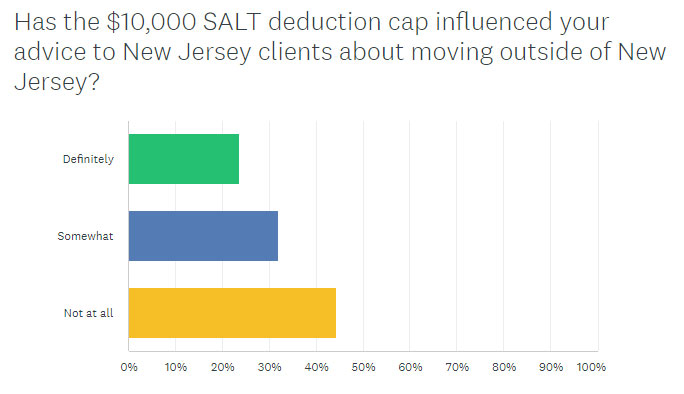

More than 55% of participants surveyed said the $10,000 SALT cap either somewhat or definitely influenced their advice to clients to move out of New Jersey, while 44% said it did not.

Respondents noted that the SALT cap impacted many more taxpayers than anticipated. Some explained that the loss of the use of the full deduction made it a “net negative impact” for certain taxpayers, and getting rid of the cap entirely would help those in high-tax states like New Jersey. As one respondent noted, “Homeownership is becoming further out of reach for your average income earner.”

Other respondents explained that higher-income earners were generally subject to the alternative minimum tax (AMT), which limits the percentage of taxes paid to the federal government regardless of deductions, and fewer paid the AMT under the TCJA. One participant noted that those taxpayers in income brackets between 15% and 39.6% generally experienced less tax than before the SALT cap.

“Surveys like this show us what a crucial role CPAs play in our society and in helping individual taxpayers and businesses thrive. Our members, who are well-versed in state and federal regulations, are a significant resource to communities and legislators,” said Aiysha (AJ) Johnson, MA, IOM, CEO and executive director at the NJCPA.