by

Aiysha (AJ) Johnson, MA, IOM | NJCPA CEO and Executive Director

| October 21, 2024

A New CPA Path Emerges

As we think about the fall season, we have a lot to reflect on. The 150-hour requirement for CPA licensure is always top of mind. After much discussion over a long period of time, the American Institute of CPAs (AICPA) and the National Association of State Boards of Accountancy (NASBA) recently unveiled an alternative pathway to the standard 150-hour requirement. The proposed CPA Competency-Based Experience Pathway is intended to help the accounting profession fix our well-publicized CPA well-publicized CPA shortage.

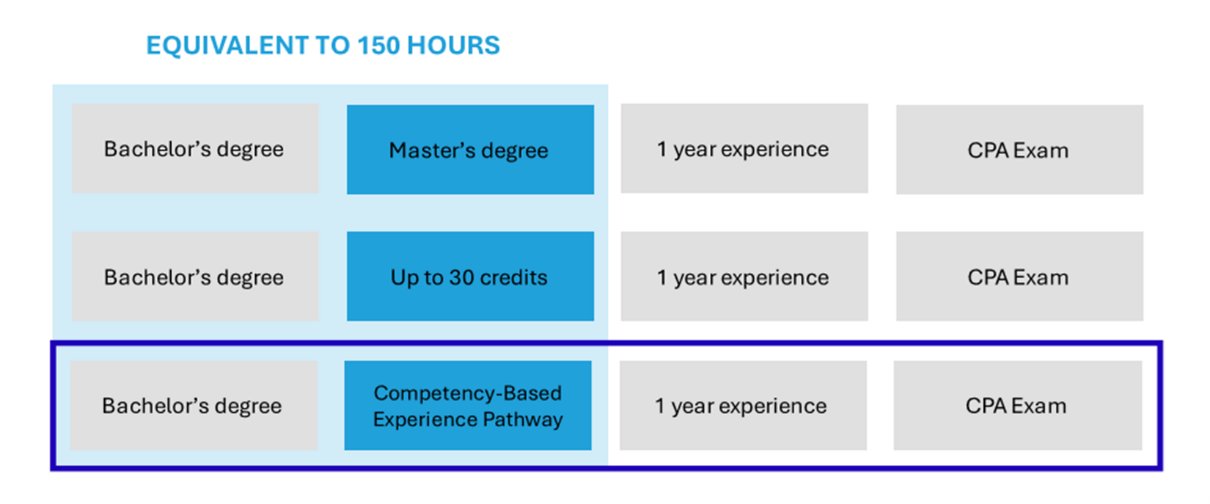

The additional option would not replace existing pathways to licensure but aim to provide an alternative pathway for candidates without lowering the bar to enter the profession. The proposed pathway would allow CPA candidates to obtain an additional year of competency-based work experience instead of the additional 30 hours to demonstrate their professional and technical skills. (See the chart below.) Candidates would still be required to earn a bachelor’s degree, complete one year of general experience and pass the CPA Exam.

Under the proposal, candidates could become a CPA by demonstrating skills in areas such as ethical behavior, critical thinking, audit services, tax engagements and financial reporting based on a year of competency-based work experience. Candidates would be required to exhibit all seven professional competencies and at least one of the three technical competencies, which would be verified by at least one “CPA Evaluator” in their organization. In addition, a CPA Candidate must obtain one year of general work experience.

In line with that proposal, the AICPA and NASBA are also recommending changes to the Uniform Accountancy Act (UAA). The UAA model legislation gives state legislatures and boards of accountancy a national model that can be adopted in full or in part to meet the needs of their own jurisdiction. The changes in the UAA provide for implementing the competency model. They would also make changes to the current substantial equivalency provisions in the UAA, which would be monitored and implemented by NASBA.

Comments on the proposals are due Dec. 6 and Dec. 30, respectively. The AICPA and NASBA are aiming to finalize the framework as early as February.

We at NJCPA support an alternative pathway to licensure but we have fundamental differences with the AICPA/NASBA proposal on how to get there. The basis of our recommendations is to ensure ease and to streamline the process to reduce barriers to licensing while supporting the rigor that is expected to enter the profession.

The two proposals were reviewed at the NJCPA’s Board of Trustees meeting on Sept. 26. The Board supports licensure with an additional year of experience instead of 30 credits but does not support the proposal’s requirement that the first year of experience be done within the competency-based framework outlined in their proposal. We are concerned about the onerous compliance requirements on employers to document specific competencies. We are also concerned about the potential to disproportionately impact small firms.

The Board did not support the draft UAA’s proposal to adopt a modified version of the current substantial equivalency system to provide for interstate mobility. Instead, the Board supports the concept of “automatic mobility,” which provides mobility privileges to any person with a CPA license in any other state, so long as they have passed the CPA exam, received a bachelor’s degree, and have two years of experience.

A member working group was formed by the Board to compose the NJCPA’s response by November, which will be shared with members and interested stakeholders. We’d also like to hear from you at feedback@njcpa.org.

You can learn more about the proposals at our free webinar on Nov. 13 or Nov. 19. And, as always, learn more about what the NJCPA and others are doing to meet the pipeline challenge at njcpa.org/pipeline.