The Current State of Professional Liability Protection

By John Raspante, CPA, MST, CDFA, McGowanPro and Lawrence Reisman, EA, LK Reisman –

November 1, 2024

With the ever-changing accounting and auditing pronouncements, there will likely be an increase in litigation against CPAs. While the historical claim patterns will continue, it’s imperative CPAs become vigilant in understanding the laws and recent court case victories to protect themselves and their practices.

The In Pari Delicto Defense (IPDD) is a protection in professional liability claims asserted against public accounting firms. Essentially, IPDD means “in equal fault.” Consequently, where a plaintiff and a defendant are mutually at fault for causing damages, the plaintiff/client cannot avoid its own liability and make a recovery against the defendant. It should be noted that each state may apply the IPDD differently, and the results may vary if the auditors were, in fact, negligent in failing to detect. Further, states vary as to the suitability of the IPDD as it relates to trustees and receivers. For CPAs, it’s a potential benefit.

Two Key Metrics

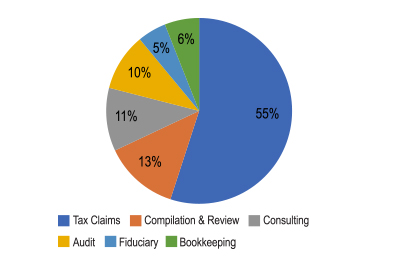

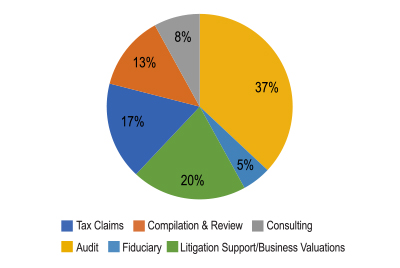

In analyzing professional liability claims against CPAs, two metrics are considered: frequency (number of claims) and severity (dollar amount of the claims). The major providers of CPA malpractice insurance typically report the highest frequency occurs in tax services, yet the highest severity occurs in audit services. The following charts reflect the frequency and severity in major areas of practice.

Claim Frequency in Major Practice Areas

Source: McGowanPRO

Claim Severity in Major Practice Areas

Source: McGowanPRO

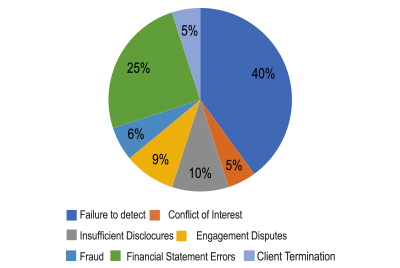

In addition, by evaluating the source of the loss in audit services, 40% occur where the auditors failed to detect fraud and embezzlement, as outlined in the chart below.

Percentage of Audit Claims

Source: McGowanPRO

Recent cases reveal that the IPDD may provide some relief in claims asserting a failure to detect fraud and a failure to detect embezzlement.

According to PwC, in Teachers’ Retirement System of Louisiana v. PricewaterhouseCoopers LLP, investors asserted on behalf of American International (“AIG”) that PricewaterhouseCoopers, LLP, failed to detect or report fraud perpetrated by AIG’s senior officers. The trial court held under New York law that the wrongdoing of AIG’s senior officers was imputed to AIG itself and dismissed the claims under the doctrine of In Pari Delicto.

As a result of the accounting profession being burdened by litigation arising from business failures, bankruptcy and failure to detect fraud and plaintiffs seeking “deep pockets,” it’s important to discuss this defense with risk managers, audit staff and professional liability carriers.

| John F. RaspanteJohn F. Raspante, CPA, MST, CDFA, is the director of risk management for McGowanPRO. He is on the NJCPA Content Advisory Board and the Accounting & Auditing Standards Interest Group. More content by John F. Raspante: |

Lawrence ReismanLawrence Reisman, EA, is the managing partner of the accounting office of LK Reisman. |