New Jersey Tax Law Changes for 2018

by Kathleen Hoffelder, content editor at NJCPA –

December 19, 2017

Retirees and other New Jersey residents will face a variety of tax changes in 2018 as part of the provisions in the Transportation Trust Fund and tax relief bill of 2016. While many of the provisions took effect in January 2017, there are four that take effect January 1, 2018.

Veterans Exemption

Individuals who are honorably discharged or released from active duty in the Armed Forces, Reserves or National Guard the last day of the tax year are now eligible for an additional $3,000 personal exemption. Those seeking to claim the exemption have to certify they are exempt before filing with New Jersey’s Department of the Treasury by mailing, faxing or uploading secure documentation. No PDF attachments to e-file returns will be accepted, according to NJCPA members who discussed the issue on its Open Forum.

According to the Treasury, if someone does not certify before filing for the exemption, he or she will need to submit documentation showing the honorable discharge or release. The Treasury will provide a letter of receipt confirming a person’s eligibility in January of the first year he or she meets the qualifications. For example, 2017 letters will be issued after January 1, 2018.

Those individuals who have had trouble locating their Certificate of Release or Discharge from Active Duty (Form DD-214) or have a form that is not computer generated have been advised to contact the United States National Archives and Records Administration. Prior to 1950, a Form DD-214 was not issued, which is why other forms are also being accepted, say NJCPA members.

Further information about qualifying for the exclusion can be found on the Division of Taxation's website.

Sales and Use Tax Reductions

The New Jersey sales tax rate will decrease to 6.625 percent from 6.875 percent, effective January 1, 2018.

Retirement Exclusions

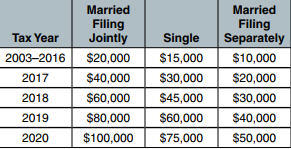

Retirement income exclusions go up in 2018 for those individuals who are over the age of 62 and have gross income of $100,000 or less. For tax year 2017, if filing jointly, the retirement income exclusion is $40,000, while it’s $30,000 for individuals and $20,000 for separate filers. This compares with $20,000, $15,000 and $10,000, respectively, for prior tax years. See table 1.

Table 1

(Source: New Jersey Department of the Treasury)

Estate Tax Eliminated

The estate tax will be eliminated on January 1, 2018. It has been gradually phased out, with the first $2,000,000 of an estate not taxed for any resident who passed away in 2017.